Personal Finance Information

How to Build a Healthy Money Mindset for a Stable Financial Future

Building and managing your wealth is a lifelong process that can have major implications for you, your children and other beneficiaries. While your path to building wealth should be tailored to your circumstances, this three-pronged approach from Freddie Mac can help you plan for a stable financial future.

New Year, New Finances: Why You Should Work With a Financial Planner

As 2024 gets underway, it’s time to set new financial goals and make a plan to reach them.

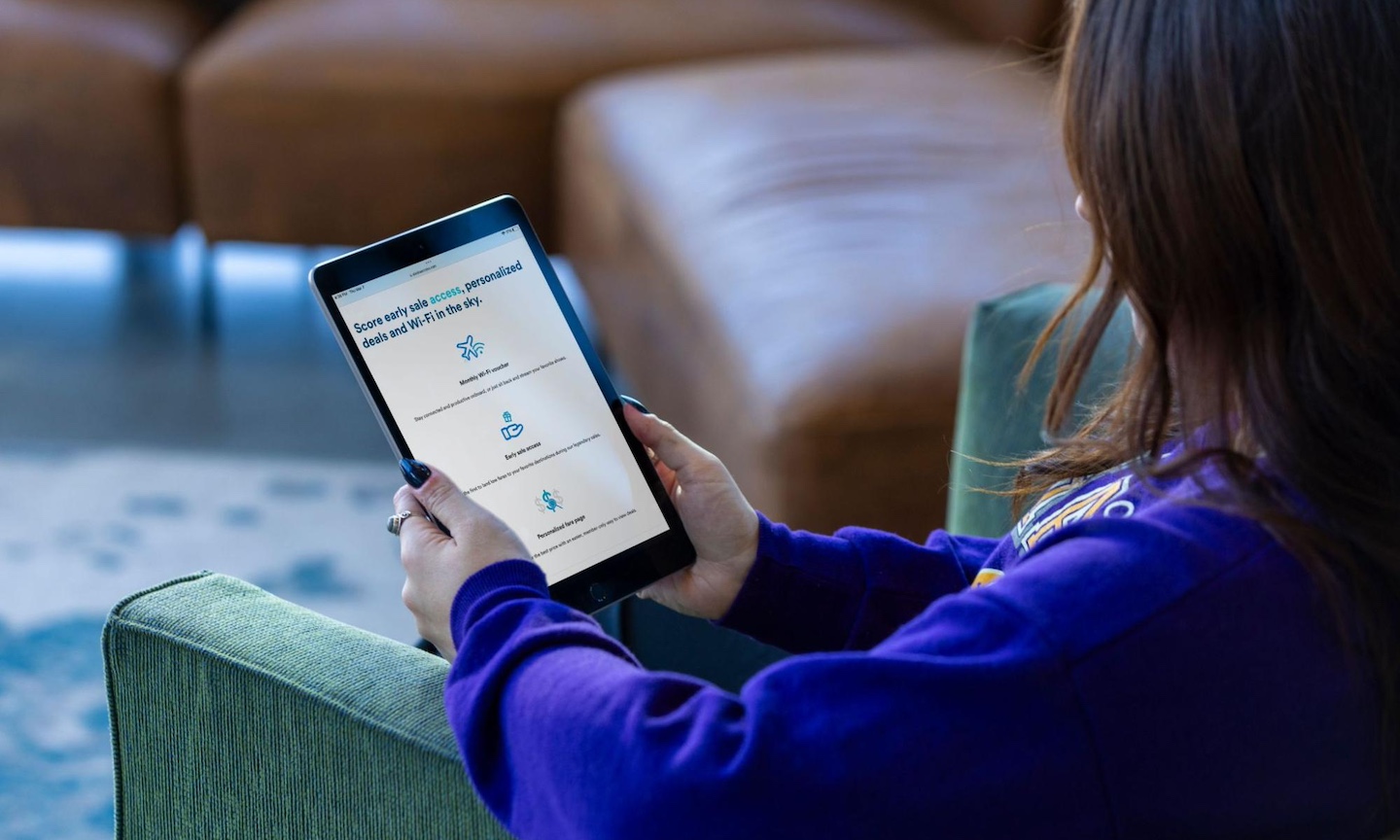

Can You Trust Financial Advice You Find Online?

Can you trust the financial advice you find online, including on social media? Nope. And a majority of people already don’t trust online financial advice. According to the CFP Board Consumer Sentiment Survey — Trust, But Verify, 71% of investors indicated little to no trust in the financial planning advice received from social media.

5 Tips to Make Saving Money a Habit

It’s no secret that saving money is hard. Millions of Americans are living paycheck to paycheck and four out of 10 have less than $400 in savings.

How to Score a Financial Touchdown this Football Season

If you’re like many football fans, your love of the game comes at a cost.

How Families Can Protect Generational Wealth

A home is often the most valuable asset a family can own. It serves as a wealth-generating opportunity for current and future generations as the home’s value appreciates over time. Yet, for hundreds of thousands of people who inherited their land and homes from family members, these assets could be at risk.

Buying a House Could Be the Best Investment You Ever Make

The path to homeownership can be bumpy. Buyers must withstand bidding wars, contingencies, complex tax laws and an array of market factors beyond most anyone’s control. Still, buying a house is typically the single best investment a family can make.

Tips to Build a Stable, Sustainable Financial Future for Your Family

Building wealth is not as easy as it sounds. It can take time, discipline and a plan to keep those dollars protected. However, if done correctly, it can provide security for your family for years to come.

5 Tax-Efficient Strategies to Include in a Holistic Financial Plan

As consumers focus on filing taxes and spending returns, a new study reveals a need for increased awareness around tax-efficient financial strategies.

The Easy Way to Balance Your Checkbook

Yes, you can balance your checkbook every month to the penny with a minimum amount of time and effort. It is very important to do so in today's world to prevent yourself from becoming a victim of fraud and identity theft.

How to Spend Wisely at the Grocery Store

Whether you are packing school lunches or hosting a dinner party, you want your fridge and pantry to be stocked with the highest-quality foods for the best value. Thankfully, there’s a better way to navigate store aisles than just picking products at random and hoping for the best, one which doesn’t involve hours of product research.

3 Ways to Protect Your Finances and Your Family

To protect your finances and family in the long term, it’s important to not only reevaluate your saving and spending, but also commit to creating a more holistic financial plan.

5 Financial Tips for Newlyweds

February is the month of love and one of the most popular times of year for couples to get engaged. According to a recent study, 36% of respondents said Valentine’s Day is the most romantic day to propose.

Should I Buy or Rent a Home?

If you’re feeling stressed about rising rents and interest rates, you are not alone. Most American renters say their rents increased in the past 12 months, and for many, their wage gains didn’t keep pace. In addition, mortgage rates have reached a two-decade high.

How to Turn Your Finances Around in the Months Ahead

Many consumers are feeling financial strain after a challenging economic year in 2022. One in three Americans say they are struggling to get by or are in trouble financially, according to Lincoln Financial Group’s Consumer Sentiment Tracker.

6 Things to Consider Doing if You Can’t Pay Rent This Month

The average national rent surpassed $2,000 for the first time ever in 2022, which has made keeping up with rent payments challenging for millions of people across the United States. In fact, a recent Freddie Mac survey found that 70% of renters are concerned about making their rent payment in the short term.

Pandemic Make You More Concerned About Finances? You’re Not Alone

The COVID-19 pandemic disrupted nearly every aspect of people’s lives and, as it turns out, it also impacted their feelings about financial security and life insurance. In a national survey commissioned by Erie Insurance: